Looking to Sell Your House During Probate in Jacksonville FL ?

So your here, probably wondering ….

“How do I sell my house in probate or inherited home in Jacksonville FL?”

When someone passes away, it can be a very difficult time. Determining what happens to the person’s estate and assets, particularly their house can be a challenge. Here, We will discuss what probate is, what the probate proceedings process entails in Florida and how all of this can impact the sale and distribution of the decedent’s property and assets.

What is Probate?

Probate is a legal process that occurs after someone passes away and he or she is referred to as the “decedent”. Any assets owed by the decedent are accounted for, then sold to pay any debts owed to creditors or funeral expenses and any remaining assets are then distributed to heirs or designated beneficiaries. Generally, probate proceedings and the distribution of assets are completed in accordance with a will (testate) or without a will (intestate). The timeline for a probate proceedings can range but typically takes 6 to 9 months to complete.

How Probate Court Process Works & Timeline [ Step by Step ] in Florida

1. Gather Documents, Financial statements, and file Will

An interested party (petitioner) or executor gathers the original will if available, death certificate(s), and other items like bank/brokerage/account statements, outstanding bills, invoices, medical and funeral bills. By Florida law the custodian of the will must file the original will with the court within 10 days of knowledge of death.

2. File the Initial Documents with Probate Court in Duval County

File the initial probate documents with circuit court. A list of the deceased’s property, debts and estate. At this step a petition for administration is filed (Formal or Summary) contingent upon on the estate value and notice to beneficiaries is given. The circuit court Judge presiding over the probate proceedings will review the documents.

3. Receive acknowledgement of Probate Case from Court & Letters of Administration

The Duval County FL Court will determine if the will (“testate”) is valid. If there is not a will (“intestate”), then the Probate Court will appoint an administrator of the estate and follow state law for distributing assets and paying debts. Otherwise the court appoints the petitioner as personal representative (PR), they take an oath, and a bond is obtained if required by court. The (PR) then opens estate banking accounts and obtains an appraiser for estate assets as appropriate.

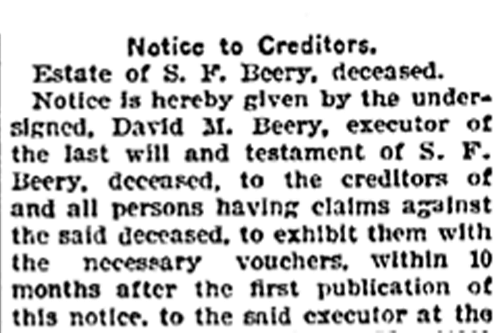

4. Give Notice to Creditors & Beneficiaries

The personal representative (PR) publishes a Notice to Creditors in the newspaper of local circulation. The estate’s attorney files a final inventory of assets and value with the probate court. The (PR) pays legitimate creditor claims and can dispute or object questionable claims made by creditors. The creditor period expires 3 months after the date publication.

5. Expiration of Creditor Period

The creditors that failed to file valid claims are forever barred from recovering from the Estate. The personal representative (PR) may make interim distributions of the estate depending on the amount of money in the Estate account. Personal property, automobiles, and specific gifts under the will are the first to be distributed. At this time, the closing may occur to sell any real property held by the Estate.

6. Prepare Final Accounting & Waivers

The personal representative (PR) working usually with a Certified Public Accountant (CPA) will file the decedent’s final income tax return and prepare a final accounting statement to present to each beneficiary that outlines all assets of the estate and value. The (PR) also outlines any personal representative’s fee and credit claims paid. In certain circumstances, a waiver of final accounting from beneficiaries is obtained.

7. Distribute Assets & Obtain Release

Through a prepared proposed plan of distribution, all beneficiaries agree to any distribution of assets before they are made. Once all beneficiaries are in agreement, the distribution of remaining assets as dictated by the decedent’s will can be made.

8. Obtain Discharge of Estate

After an acceptance of final accounting by beneficiaries is signed they consent to the release and discharge of the personal representative (PR). The Judge presiding over the probate proceeding will then sign an Order of Discharge to release liability and responsibility on behalf of the Estate and close the Estate proceedings in the Probate court.

How We Buy Probate Houses in Jacksonville FL

We purchase probate houses or inherited homes in an easy– three step process! Don’t worry about repairs, real estate commissions, or hassle! We make it easy to get paid quickly in days not months! Get an offer that is all cash, absolutely free, hassle-free without any obligation. Just fill in our GET YOUR CASH OFFER NOW form or give us a call at (904) 201-9881.

Step One-

Contact Us- Call Jax Nurses Buy Houses at (904) 201-9881 or fill in our Get My Fair Cash Offer Now form. Our team collects info about your probate property and condition to make our highest and best offer.

Step Two-

Get our Highest & Best, CASH Offer! We make an honest, transparent cash offer. No obligation, free, AS-IS offer based on comps. No mortgage or appraisal contingency.

Step Three-

Close On Your Time, you pick the closing date! Collect your cash in days, not months. No realtor commission, no open houses, and no repairs! Find out about our “super-easy” closing process.

How to Sell a House In Probate in Jacksonville FL

When you need to sell a probate or inherited house, the process can be very different than selling a house with a Realtor or for sale by owner. While a probate property can be both a gift and challenge, to sell successfully one must obtain court approval and follow the necessary and required steps before a closing can occur.

Along the say of selling a probate house- many issues can arise such as complex legal problems or significant legal delays, sibling rivalry or disagreements, and disputes among creditors. Additionally, you must keep property taxes and insurance current and pay utilities, mortgage payments, property maintenance, and any necessary repairs to keep the property from falling into disrepair. Sometimes, inherited properties can be far away from where you live. Below is al ist of steps that must occur before one can sell.

1.Obtain Permission from Probate Judge in Jacksonville FL

Through letters of administration, the probate judge gives approval authorizing the personal representative (PR) or executor to put any real estate owned by the decedent on the market. The (PR) begin taking steps to auction, list, or sell the property to a local investor such as Jax Nurses Buy Houses.

2. Obtain value of real property (House) in Jacksonville FL

The (PR) can obtain an appraisal or comparable market analysis from a licensed real estate broker to obtained an opinion of value in the present condition.

3. Sell the property (Find a Buyer)

You have different ways to market and sell the property. You can attempt to sell the traditional way through a real estate agent but you must ensure they are knowledgeable of the probate process and the nuisances. The Realtor will list the property on the local multiple listing service (MLS) and on sites like Zillow and Trulia and take 60 to 90 days to obtain an offer.

The other option is to sell to an investor that buys probate properties like our company to avoid contingencies like financing, appraisals or inspections and give you an all cash offer. Jax Nurses Buy Houses buys your inherited house or probate home AS-IS, leaving the estate to make NO REPAIRS!

4. Get Offer Approval

Once you have obtained an offer from a buyer it is submitted to the probate court. The probate judge reviews the offer to ensure it is at fair market price for real property and how the conclusion was reached (appraisal or affidavit of value from Broker) and verification that the sale is of arm’s length in transaction. While this can take time to complete (4-5 weeks), it’s best to ensure your buyer has a substantial binder deposit in escrow to ensure they stick around. Additionally, you’ll need the consent of beneficiaries of the estate or a formal notice without objection.

5. Complete Transaction & Sell the Property

Once you have receive probate court approval, you now can close the transaction and sell the property. The title company or closing attorney will obtain pay off from the decedent’s mortgage company if there was one. Any proceeds from the sale then are transferred to the estate’s banking account.

This process can take anywhere from 30-120 days depending on certain documents needed to complete the sale. These documents include things like death certificates and mortgage satisfactions. Once the property has been sold and closed on, the net proceeds will be transferred to the estate account. Any proceeds from the sale of the property are used to pay off any estate debts, and then the remaining funds are distributed to heirs.

Considering Selling a Probate or Inherited House?

We have helped countless homeowners sell their probate or inherited home. We understand the probate process and can make this difficult time and selling your home much easier! From the moment you decide to speak with us- you will experience cash home buyers that are honest, transparent, experienced, and trustworthy.

If you have questions about the probate process or are looking to receive a free and fair cash offer on your inherited property or probate house, give us a call at 904-201-9881 or click the get my cash offer now below. Jax Nurses Buy Houses guarantees a cash offer without repairs or realtor commissions, where you select the date of closing and is fast and hassle-free.

Get Your Free Offer Today

Ready to sell your house quickly? Get a free offer for it today! Fill out the form below telling us all about your house and its present condition.